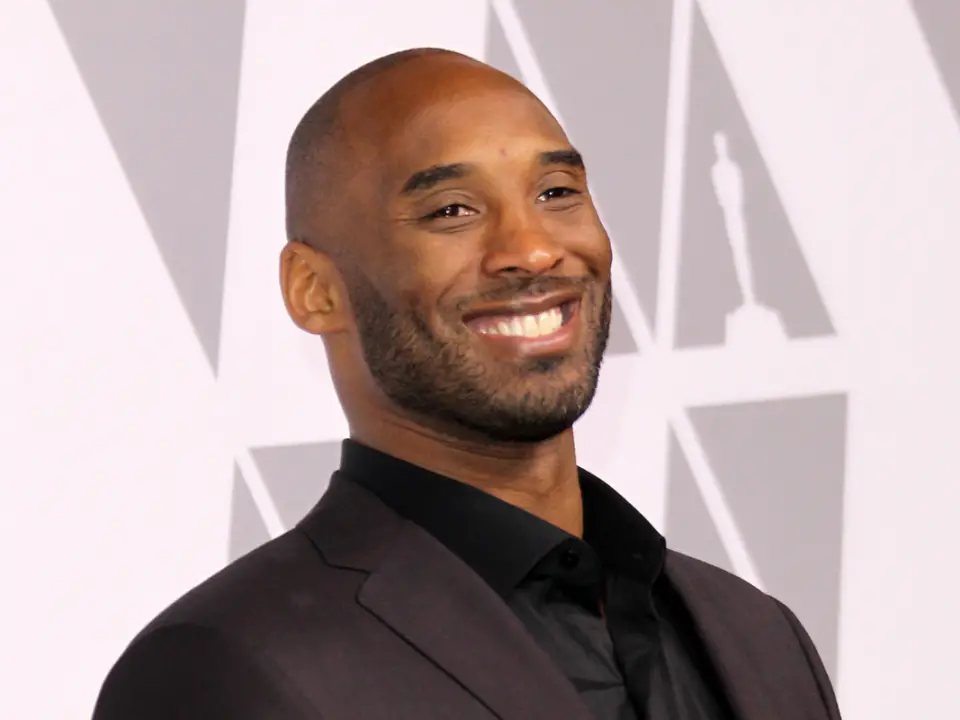

The estate of Kobe Bryant has reportedly made $400 million in the sale of BodyArmor to Coca-Cola. Kobe Bryant acquired a 10 percent stake in BodyArmor in 2013. He paid $6 million in the deal making him a major shareholder in the company.

Sports Illustrated reported the Coca-Cola purchase means the Bryant estate would earn approximately “$400 million for its stake in the company.”

BodyArmor credits Kobe Bryant as the reason for the brand’s success. “If it wasn’t for Kobe Bryant’s vision and belief, BODYARMOR would not have been able to achieve the success we had,” The company’s founder, Mike Repole is reported as saying in a press release. “I couldn’t be more excited to become part of the Coca-Cola family and set our sights on the future.”

Kobe’s widow, Vanessa Bryant took to Instagram to celebrate her late husband’s legacy with a touching message. She posted a picture of Kobe with the caption “Congratulations Papi!!! This is ‘no pie in the sky.’ You did it!” she wrote. “Always one step ahead. I’m so proud of everything you were able to accomplish. I wish you were here to celebrate. You deserve all the recognition for this. You continue being GREAT. Te amo per siempre. Congratulations Kobe, Mike Repole & @drinkbodyarmor team”

Vanessa added a red heart emoji and continued, “@kobebryant, you are the GOAT in everything you put your mind to.”

Last month, Vanessa filed to trademark “KB24” to create a sports and entertainment empire enabling Kobe Bryant’s legacy to continue.

The trademark application covers digital collectible items, websites, training camps, broadcasting platforms, podcasts, TV shows, movies, documentaries, and music. Additionally, the “KB24” brand will also be used for sports cards, food/drink containers, and t-shirts.