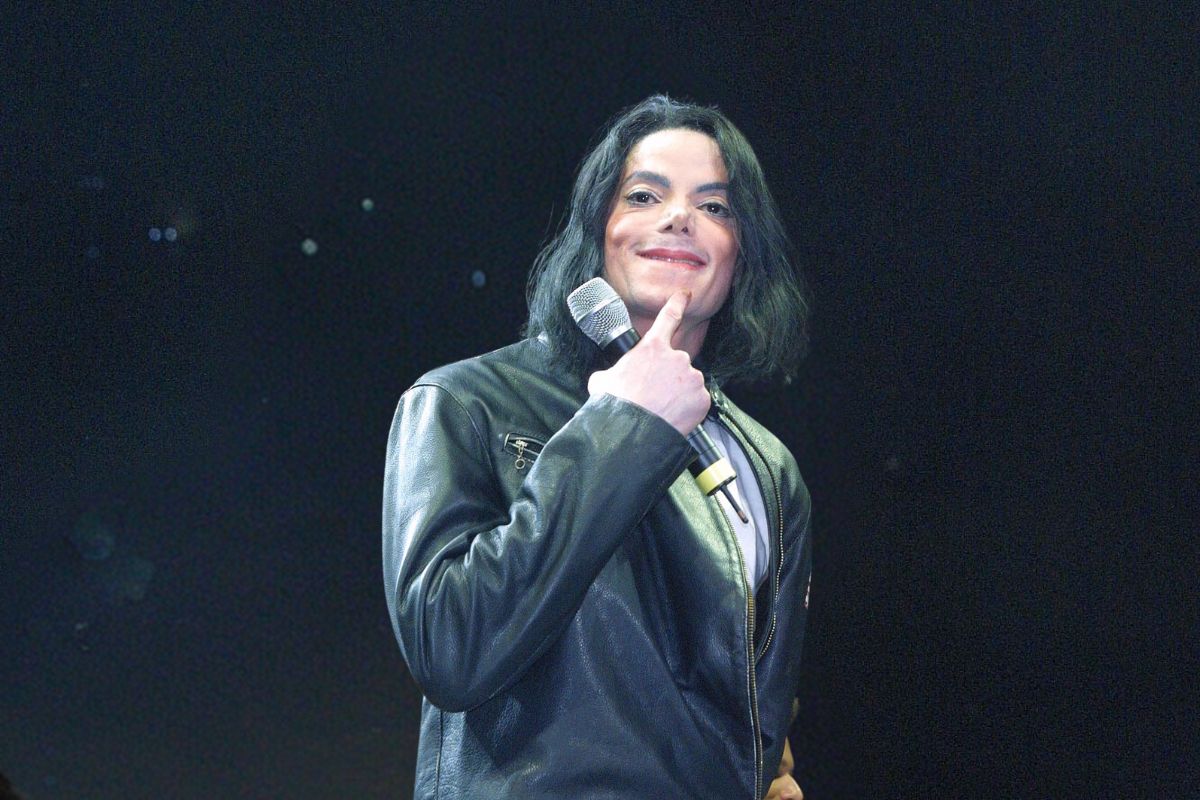

Michael Jackson’s family finds itself in a precarious financial situation, constrained from accessing the performer’s trust funds as a heated conflict with the IRS unfolds.

Pending the resolution of a formidable tax dispute with the Internal Revenue Service, the estate of Michael Jackson has temporarily halted the distribution of trust funds to his family.

This financial freeze affects his three children—Prince, 27, Paris, 26, and Bigi, 22—and their grandmother, Katherine Jackson, 94.

Documents reveal the current deadlock stemming from an unresolved IRS audit.

The saga began with an IRS audit ruling that significantly undervalued the late singer’s assets, ultimately suggesting the estate owed $700 million in taxes and penalties.

Although the estate’s executors triumphed in court in 2021, the latest motion to reassess the worth of Jackson’s music catalog has prolonged the uncertainty.

The resulting ambiguity in the estate’s valuation has prevented funds from being channeled from the trust.

Attorneys for the estate have requested judicial authorization to earmark a portion of the funds for the family trust; however, the court has withheld approval, citing an indeterminable “safe” distribution amount.

To alleviate financial pressure during this impasse, estate executors proposed issuing a temporary “family allowance” for the beneficiaries.

This financial quagmire follows Sony Music Group’s $600 million acquisition of half of Jackson’s music catalog in February.

Katherine Jackson has legally contested this transaction and is seeking estate funds to cover her legal expenses, a request the estate opposes.

Further complicating matters, Bigi Jackson lodged legal paperwork in March to challenge his grandmother’s use of estate finances for her legal disputes.