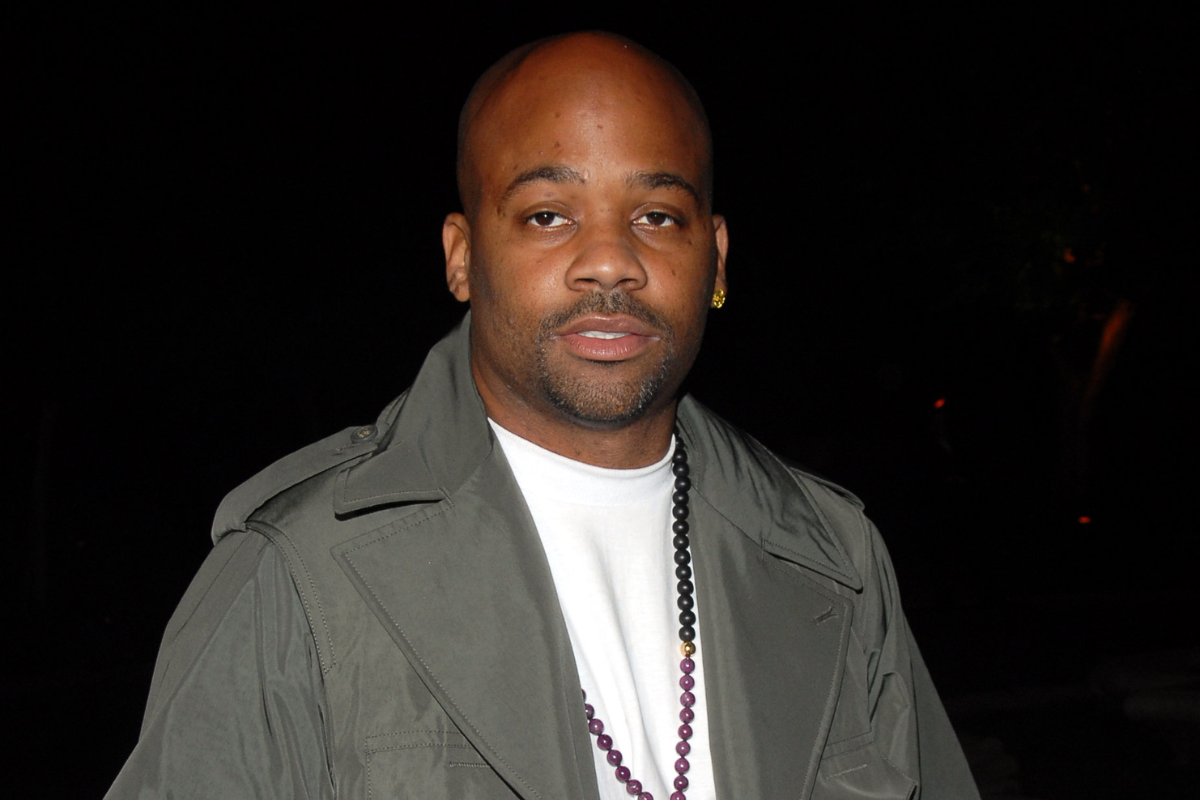

Damon Dash filed for Chapter 7 bankruptcy in Florida as he seeks protection from more than $25 million in debts mostly tied to unpaid taxes, child support and legal judgments.

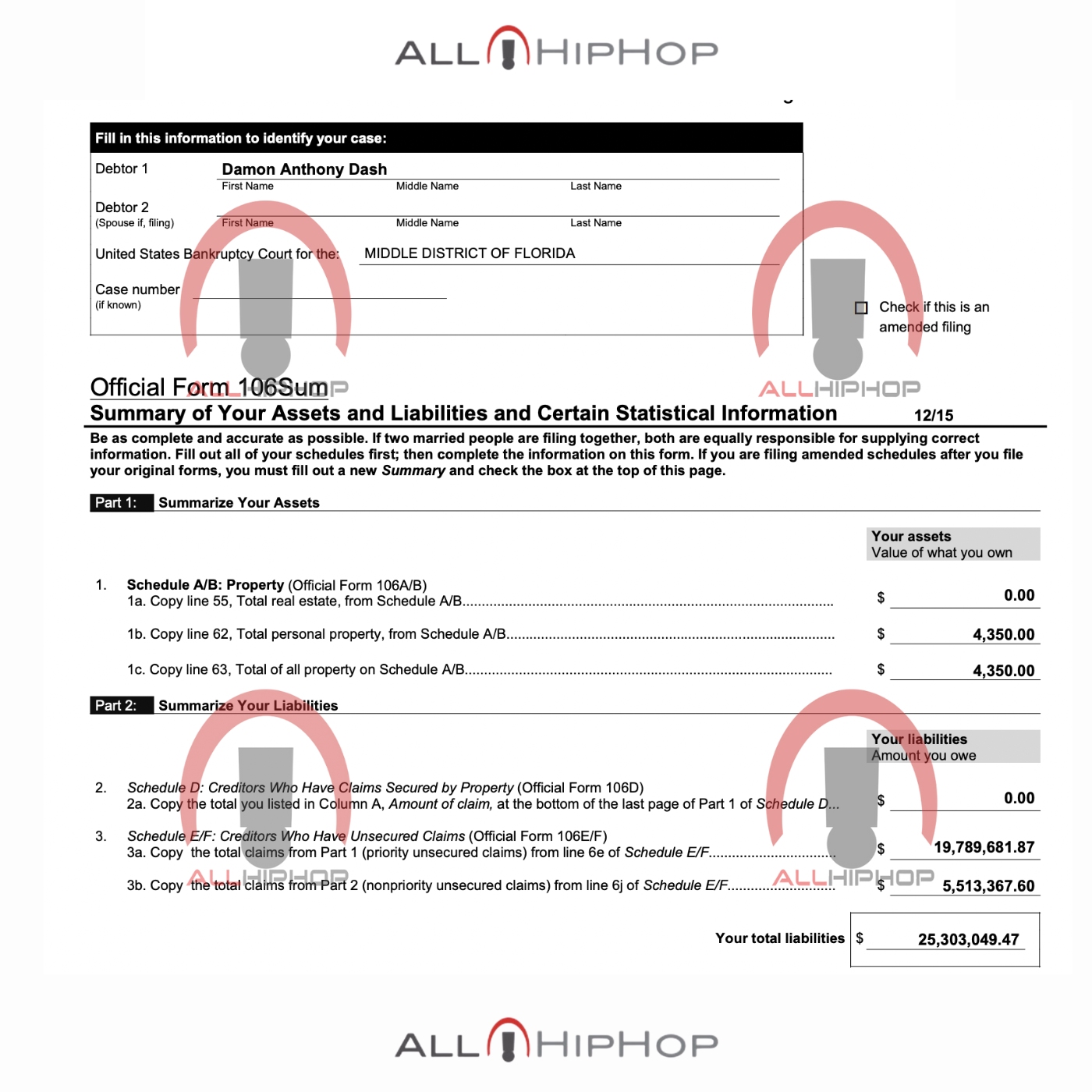

The 54-year-old Roc-A-Fella Records co-founder submitted a 56-page petition to the U.S. Bankruptcy Court for the Middle District of Florida on Thursday (September 4), listing just $4,350 in personal property.

That includes a $500 phone, $2,500 in jewelry, clothing, two firearms and $100 in cash. He reported monthly expenses of $5,200 and no income.

Court filings show Damon Dash owes over $8.7 million in back taxes to New York State and the IRS, with debts dating back to 2005. The New York State Department of Taxation and Finance alone is seeking $9.65 million, while Los Angeles County wants $5.79 million.

The New Jersey Division of Taxation is pursuing $3.5 million from the early 2000s, bringing the total to over $19 million that is due to the Federal Government.

Damon Dash also owes more than $647,000 in unpaid child and spousal support, including obligations to ex-wife Rachel Roy and Cindy Morales. The New York City Department of Social Services claims another $487,000 in arrears and educational costs.

The filing includes over $5.5 million in unsecured claims, comprising lawsuits, unpaid wages and legal fees. Among the creditors are filmmaker Josh Webber and Muddy Waters Pictures, who won a $4 million default judgment against Dash in 2025 over the film Dear Frank.

Photographer Monique Bunn is owed $30,000. Producer Edwyna Brooks is listed at $78,000, while attorney Christopher Brown is owed $100,000.

Government agencies are listed as Dash’s largest secured creditors. He disclosed that his business entities — including Dash Films Inc., Poppington LLC and Roc-A-Fella Films Inc. — currently hold no value.

In 2024, New York officials auctioned Dash’s one-third stake in Roc-A-Fella Records for about $1 million to help pay off his tax bill. However, proceeds were redirected to cover back taxes to New York and $145,096 in child support, leaving other creditors unpaid.

The court has not yet scheduled a creditors’ meeting. If approved, the case could result in the liquidation of Dash’s remaining assets.

This isn’t exactly shocking. Damon himself told the court through lawyers that he was considering making this move, which could turn out to be a shrewd business move.

Chapter 7 bankruptcy offers individuals the opportunity to hit the reset button when debt becomes unmanageable.

It clears away most unsecured bills, such as credit cards, medical expenses, or payday loans, in just a few months. Once that happens, collectors can’t call, sue, or garnish wages.

The process also alleviates stress immediately by automatically pausing collections, foreclosures, or evictions. Most people don’t lose much, if anything, because the law allows them to keep the essentials they need, such as a car, household items, retirement savings, and sometimes even a portion of their home equity.

Unlike Chapter 13, there’s no long repayment plan—often referred to as a “no-asset” case because creditors receive nothing at all.

While a Chapter 7 filing remains on a credit report for up to ten years, many people begin rebuilding their credit within a year or two, as the heavy debt is eliminated.

In short, it’s a quick way to get relief, keep what matters most, and start fresh.